Clients have more ways to find and communicate with attorneys than ever before. For attorneys, this represents an opportunity and a challenge. As an opportunity, it’s easier to directly target potential clients when they need your help. Compare the potential “right time, right place” effectiveness of a Google Local Services Ad versus an old-school yellow pages or billboard advertisement. As for challenges, attorneys face increased inquiries (which is wonderful!) that they need to manage and work to turn potential clients into paying clients.

The most effective way to track and manage referrals is with tools purpose-built for the task. This type of program is called client relationship management software (“CRM”). A CRM helps you plan, control, review, and report on the entire client intake process, from initial marketing to signed engagement agreement.

A CRM Built for Law Firms

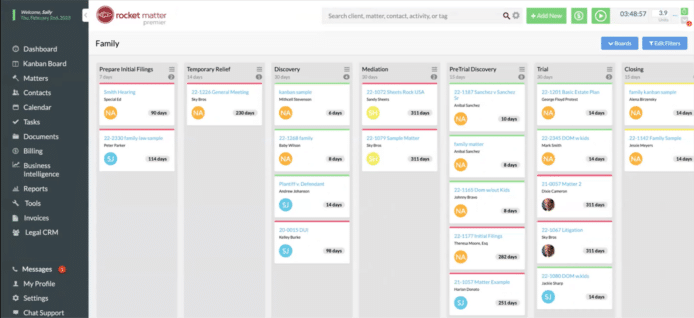

Think about the steps you take from receiving a lead to signing a client. You’ll see several types of interaction. Some may require a personal touch, while others could be systematized and automated, freeing time for other work. Law Ruler is a CRM designed for these types of workflows and how law firms engage prospects.

Capturing and Engaging Leads

While word of mouth remains a powerful recruitment vehicle, digital tools help keep you in mind when a would-be client is ready to engage.

Suppose you are an estate planning attorney and you conduct an educational presentation for seniors in your area, you might collect attendee names and email addresses. What now?

Traditionally, you may set that list aside or keep a record to see if the event generates business. More sophisticated firms may send a follow-up email or letter with a brochure. Law Ruler lets you do much more.

Law Ruler lets you take that list of names and email addresses and start them on a series of informational emails you design—a “drip campaign” in marketing terms. You could design a series of automated emails that Law Ruler sends out, one a week, on the “core” estate documents—will, trust, power of attorney, and healthcare directive. These four emails build on or reemphasize your points. A fifth email is a summary reminder of your services and link to schedule a consultation.

You provide valuable, expert information to the prospect, stay front-of-mind with the attendee, and make it easy to take the next step.

Law Ruler’s drip campaign tools support multiple approaches, including texting with pictures and videos and pre-recorded voice calls. Law Ruler’s platform integrates texting, so messages originate from a central firm number and are stored and visible to other Law Ruler users in the firm.

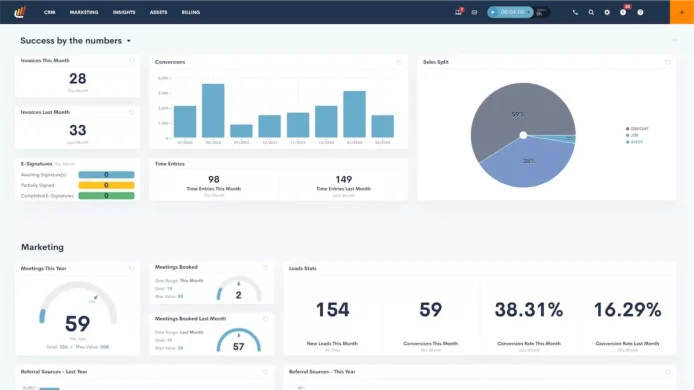

Tracking and Reporting on Outreach

Marketing emails and text campaigns only work if they’re read by the recipient and that recipient becomes a client. Naturally, Law Ruler provides robust analytics in a dashboard view to see relevant information. Instantly know key metrics like:

- click-through rates (e.g., what percent of email or text recipients click on a link in a message);

- conversation rates (e.g., what percent of prospects become clients); and

- average time to conversion (e.g., how long does it take a prospect to become a client).

Law Ruler lets you schedule these as recurring reports, as well as design custom reports in a “code free” interface.

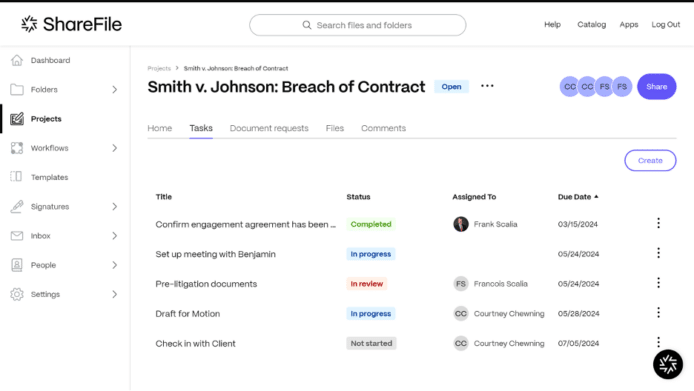

Managing Lead Qualification

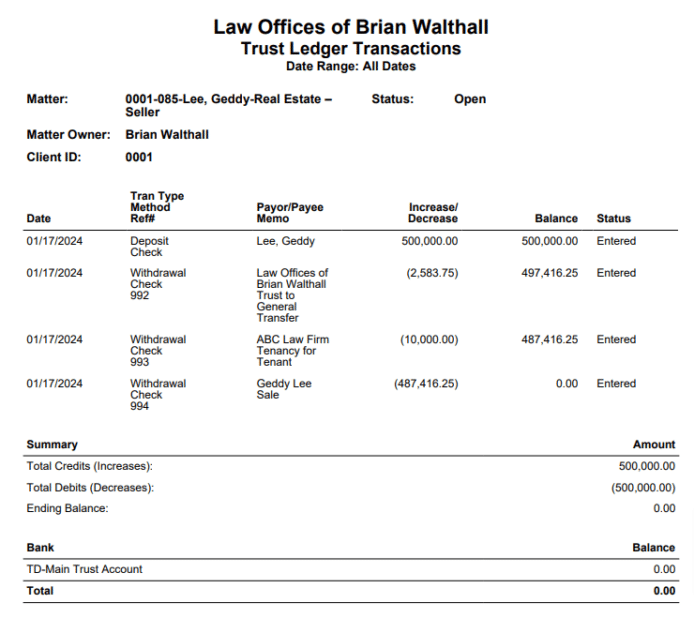

Once your outreach spurs a potential client to act, Law Ruler helps you evaluate and qualify the lead to see if the prospect’s needs match your expertise. With Law Ruler, your intake coordinator could:

- use Law Ruler’s form builder, featuring on-the-fly, adaptive questionnaires to collect matter facts;

- feed form-collected data into custom fields in Law Ruler, simplifying staff work to review and filter prospects, while avoiding the error-prone process of retyping previously entered details; and

- ease key steps of the onboarding process via automated documents, such as engagement agreements, generated with form-collected data, and send for digital signature via email or text message.

Powerful CRM, Made Even Greater with AI

Law Ruler includes the talents of ChatGPT to speed up everyday marketing and client communication. ChatGPT and Law Ruler’s AI Email Assistant streamline routine marketing communication tasks, alleviating burdens while producing better, repeatable results in less time.

Law Ruler users can take advantage of ChatGPT integration to:

- generate potential social media posts that match custom SEO guidelines;

- produce first drafts of client communications, like welcome letters, questionnaire instructions, and meeting, deadline, and appointment reminder; and

- even create initial drafts of actual legal documents for attorneys and staff to review, edit, and revise.

Additionally, Law Ruler users benefit from using ChatGPT within a product purpose-built for law firm customers. Law Ruler designed its ChatGPT integration with security top of mind. When using ChatGPT inside Law Ruler, ChatGPT has no access to client data and is prevented from saving and “learning from” any information you enter as a prompt. This structure lets firms use AI and still maintain compliance, preserve privilege, and fulfill ethical obligations to clients.

Systematize Great Marketing and Powerful Lead Management with Ease

Visit Law Ruler’s website to learn more about how their legal-specific CRM helps law firms save time by eliminating manual processes and streamlining their client intake process. If you’d like a hands-on walk-through of Law Ruler, including its phenomenal AI features, click here to schedule a demo.