Do you know the largest source of client complaints about lawyers? Communication—unreturned calls, unanswered emails, etc. The second largest source of complaints? Money. More specifically, how attorneys handle their clients’ funds.

Law Firm Accounting Complexities

Accounting plays an essential role in any business. No matter the industry, a business tracks profit and loss, tax events, and other financial measurements. Law firms do all of that while also precisely accounting for receipts and disbursements on a per-matter basis.

In some respects, trust accounting—tracking the funds we receive from or on behalf of clients, but haven’t earned for ourselves yet—is easier than standard business accounting:

- We don’t have to monitor profit or loss;

- We don’t record depreciation of physical assets or amortization of intangible assets; and

- We don’t worry about interest earned or tax events.

If law firms only had to worry about their trust account (also called an IOLTA, IOLA, or escrow account, depending on your jurisdiction), they might have it easier than a generic business or non-profit. Unfortunately, a lawyer’s trust account burdens exist in addition to general business accounting requirements.

Software Simplifies the Situation

Fortunately, the additional needs of trust accounting match what computers are good at:

- Tacking client funds on a per-matter basis;

- Matching each receipt or disbursement to supporting documents; and

- Painlessly reconciling numbers between the firm’s electronic ledger, the bank’s reported amounts, and the trust balances for each matter.

General purpose accounting can do some, but not all, of this. Maybe it could hold “audit-important” documentation and reconcile between itself and the bank, but it lacks the core tools lawyers need. In the same way firms benefit from law practice management software to keep matters organized, firms need accounting software that understands trust accounts, matters, and their unique roles in legal.

The right legal-specific accounting software alleviates much of the stress.

CosmoLex Offers the Right Trust Accounting Tools

CosmoLex’s robust, approachable trust accounting makes it easy to record and report your trust account activity properly.

Leverage Tools to Do it Right the First Time

The money-centric client and disciplinary complaints mentioned above don’t stem from attorney malfeasance. Most disciplinary complaints result not from deliberate misappropriation but from negligence. A solution, like CosmoLex, that encourages (and can compel) good recordkeeping, promotes compliance and prevents problems.

If your firm relies on a “general purpose” accounting program and a separate matter management program for case information and billing, that split introduces unnecessary complications. Using separate programs creates a gap for human error to seep in. If you maintain both an electronic and paper calendar, and they disagree, you lose time determining which is correct. Similarly, no one should play a “financial telephone” game, relaying numbers between products and hoping no errors arise.

CosmoLex provides practice management and full, general ledger accounting in one place. Manage case details, bill clients, and track and reconcile business and trust accounts in one web-based, mobile-friendly product.

Beneath that single-source umbrella, CosmoLex:

- Collects all necessary transaction reference information in an audit-ready fashion;

- Separates trust account money and transaction activity by matter and client, preventing commingling of different clients’ funds;

- Supports computer-printed checks to prevent duplicative check numbers or writing checks from the wrong account;

- Guards against overdrawing not only the overall trust account, but also overdrawing any individual matter’s trust balance;

- Allows you to “close the books” on a matter or time period to prevent further edits or alterations; and

- Connects to your bank or financial institution to directly import transaction data for you to review and confirm.

Quickly Run Reports to Verify Accuracy and Completeness

Meaningful, actionable reports begin with good data. Quality reports depend upon quality bookkeeping. CosmoLex produces reports that keep you informed and compliant with jurisdictional obligations. Core, insightful reports include:

- Trust Ledger Balance Report: This report, known to Canadian practitioners as a Trust Listing, shows trust balances for each client by matter, the last date of any activity, and whether the matter is open or closed.

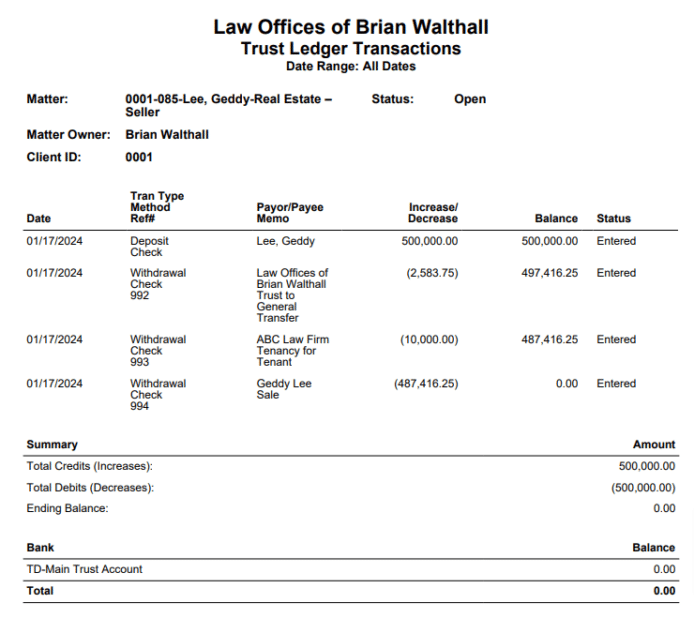

- Client Trust Ledger: This report is a mini bank statement for each matter. It shows credits and debits for the matter, complete with a running balance. If you have a single matter’s funds in multiple trust accounts, it also accommodates that variation.

- Reconciliation Report: This report compares the bank’s ending balance to your recorded ending balance. It also reveals uncleared transactions, such as uncashed checks.

- 3-Way Reconciliation Report: This report builds upon the reconciliation report, showing the bank’s numbers, your trust account’s overall numbers, and client ledger numbers. 3-way reconciliation reports ensure that bank totals match trust account totals and that both totals agree with what matter-level ledgers report. Auditors love this report.

Best Practices Produce the Best Results

The fundamentals drive stress-free trust accounting.

- Run the reports monthly and act on issues. Closed matters shouldn’t have trust balances. Investigate dormant accounts and uncashed checks. Relocate unassigned funds to their proper matter.

- Know your audit requirements.

- Keep records, including copies of deposit slips, canceled checks, and statements, for the relevant time period.

Make accounting more effortless by doing the right thing promptly with easy access to relevant, verified financial information. CosmoLex helps your firm’s trust accounting keep the proper records, meet jurisdictional and audit requirements, and generally run smoothly. Learn more and schedule a demo at CosmoLex’s website.

Share Article

Last updated February 1st, 2024