Trust accounting seems pretty straightforward: keep money that isn’t yours in a separate account. But not so fast! As your practice and number of clients grows, trust accounting is not as simple as it seems. You’ll have to navigate jurisdictional rules while dealing with banks and credit card processors that know nothing about those rules. You’ll also have to manage the ledgers, accounting, payments, and balances for each client’s trust accounts. Tabs3 Trust Accounting Software manages trust accounts for your clients accurately and easily.

Why Use Dedicated Software for Trust Accounting?

To effectively manage trust accounts, you need something beyond just using an Excel sheet. And switching between multiple programs isn’t an option either, unless you want to spend hours each week making sure your books are balanced. A better solution is to have a single software that can streamline trust account management and scale with your practice. You’ll want something with safeguards in place to give you peace of mind over trust transactions. This is where having dedicated software comes in.

Having dedicated software for trust accounting doesn’t just help you stay compliant with your jurisdiction’s rules. It also simplifies your accounting workflow, so you know exactly what to do and when to do it. These days, most trust accounting software is bundled in with other legal software as a suite of services. All of this is intended to help reduce the number of hours attorneys spend on administrative tasks. While many law firm software options say they have trust accounting features, they may not go far enough to reduce accounting headaches. Ideally, trust accounting should offer features that allow you to easily have an overview of where your firm stands with your trust accounts. It should also make managing incoming and outgoing payments from those accounts easy and help you stay compliant. This is something the Tabs3 suite of software and Tabs3Pay does and more.

Manage Trust Account Payments with a Click

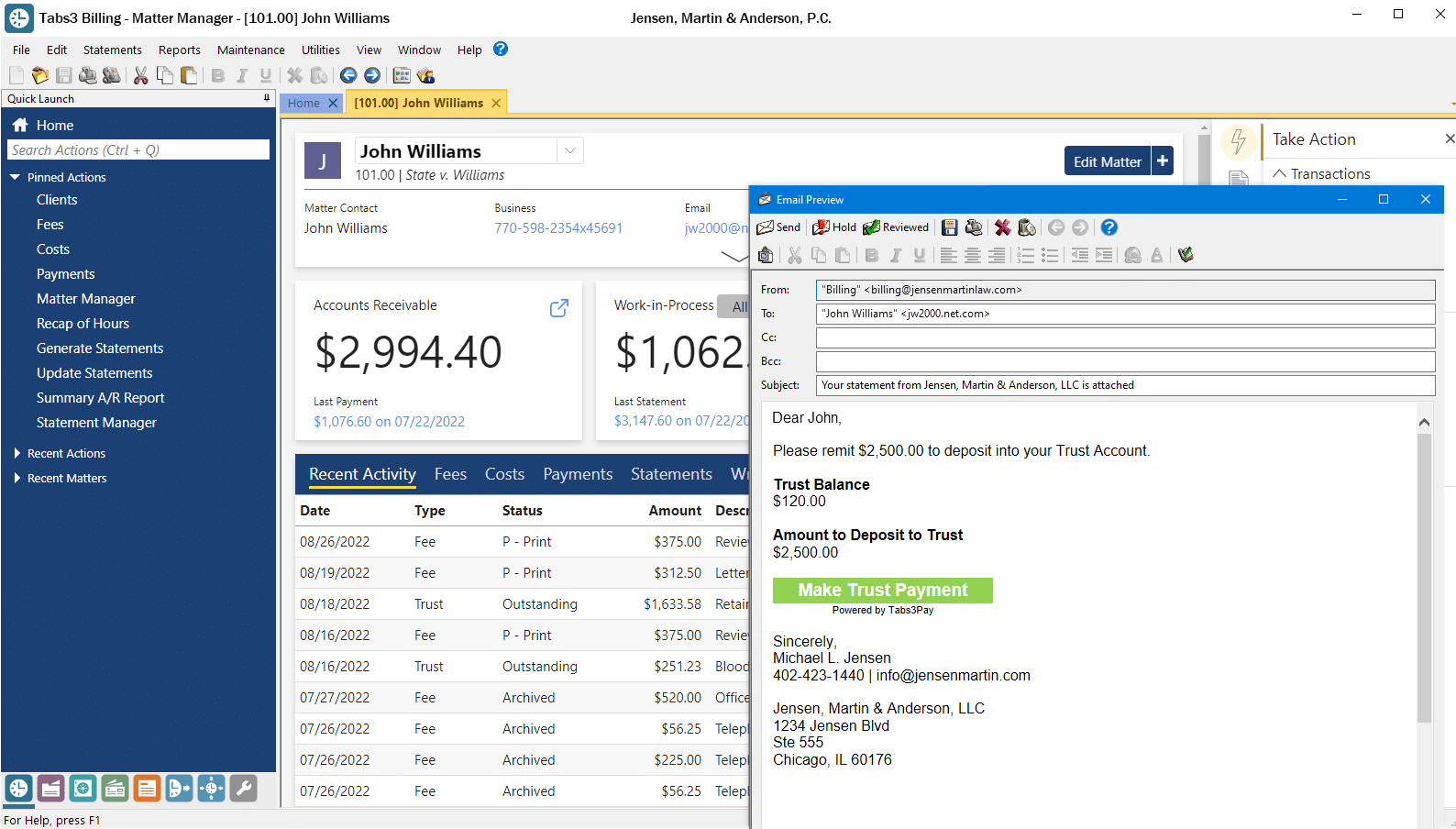

Tabs3 gives you a quick overview of where your trust accounts stand. It lets you know what you need to do at just a glance. When viewing a client’s account, you’ll immediately see the trust account balances. Tabs3 will also let you know when those balances are getting low. You’ll be able to set recommended amounts for trust accounts and get a warning when you’re at or below a certain level. And if you’re below that level? Simply click a link to generate a trust request to email to your client. The email will come directly from your law firm’s email address, and it will have a custom payment link for clients to pay securely via credit card, ACH, or debit card. Tabs3’s trust account features turn a complicated and time-consuming part of your practice into a streamlined solution.

Make it Easier for Clients to Pay

Emailing a custom payment link to clients isn’t limited to trust accounts. Anytime you send out invoices, you can generate an email invoice with a unique payment button for paying accounts receivable or depositing into a trust account. This ensures the funds will never go into the wrong account, helping you stay compliant. And, all processing fees come out of your operating account, even if a client pays into trust.

You’ll also be able to set up default hourly billing rates or charge contingency, flat fee, or retainers. No matter the charge, clients will receive clear, detailed invoices from your firm, so they’ll always know what they’re paying. Clients will even be able to pay through Tabs3Pay’s secure portal. This means you don’t have to manually enter information when clients pay their bills. Moving towards online invoices and payments brings you one step closer to a paperless firm. You’ll have fewer accounting errors, receive payments faster, and clients will feel confident that their payment information is kept safe.

Easily Accept (Credit Card) Payments

As mentioned above, Tabs3Pay allows attorneys to accept credit card payments from MasterCard, Visa, American Express, Discover, Diner’s Club, and JCB. This makes life easier for clients (over 70% of adults own credit cards!) and helps your firm get paid sooner. And, better yet, you’ll collect a higher percentage of your billable work than firms that don’t accept credit cards. Still, many attorneys may not want to accept credit cards as payments because of the associated processing fees.

For attorneys that want to accept credit card payments but don’t want the fee, Tabs3Pay gives the option to attorneys to surcharge those costs in client invoicing. Surcharging allows you to pass the cost of processing fees to the cardholder as a separate line item on invoices.

You’ll also have the option to accept payment from clients via debit card or ACH eCheck transactions. Clients will be able to pay through their checking or savings account, giving them more options and control over their payments.

Demo Video

Tabs3 recently gave us a demo of Tabs3Pay and how its features make trust account payment a breeze. Take a look at the video below to see a walkthrough they provided our Legal Tech Advisor, Zack Glaser.

How to Get It

If your law firm wants to learn more about Tabs3Pay or the Tabs3 suite of software to help make your practice management more efficient, contact them at tabs3.com to schedule a free personalized demo or sign-up for a free trial.

Share Article

Last updated August 30th, 2023