Firms of all sizes fail because they do not pay attention to collections. While recording hours and billings are important, cash flow is mission critical to all businesses. In this third installment of our five-part series, we shift from client development to examine a collections KPI that will drive improvements to your administrative processes.

Most firms pay staff and their bills on a regular cycle, usually within 30 days. Therefore, you must collect from clients at least within the same time frame. Otherwise, the firm will be forced to borrow money or dip into reserves. We use an aging tolerance for clients’ monies owing or accounts receivable (A/R) to monitor collections.

Most legal practice management systems and all accounting software create an aged A/R listing. This report shows how much is outstanding currently and over thirty, sixty, ninety, and one hundred and twenty days.

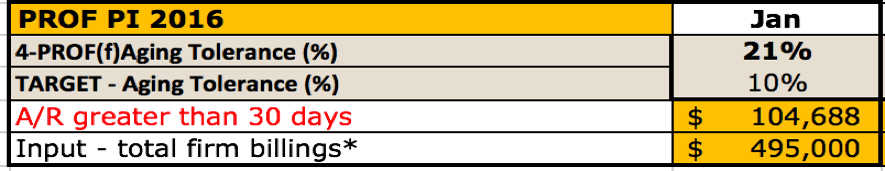

Using the example above from my small law KPI book, the PI firm has billed out $495,000 in January and their target is to collect all but 10% of that within the next 30 days. In other words, at any given time, only 10% of the money owed by clients should be outstanding for over thirty days. This target would be created based on the amount of cash flow needed to pay the bills. The A/R greater than 30 days of $104,688, or 21% of the monthly billing of $495K, is cash that is not accessible to pay the PI firm’s bills.

With this result, this PI firm can do the following:

- Review prior months to see if there is a trend or if this is an anomaly;

- Investigate the $104,688 to review if there are one or two large amounts or many small amounts and try to see if there is pattern;

- Follow-up on the A/R over 30 days weekly by contacting the clients;

- Analyze the days that time remains unbilled as perhaps the bills are stale by the time they reach clients; and

- Accept payment online and use retainers where possible.

Many small firms just look to the bank balance to see if they are okay. However, it’s too late to make changes if you wait to see how the month turns out. An aged A/R listing can help firms keep better track of their cash flow.

Originally published 2017-03-30. Republished 2019-12-19.

Share Article

Last updated October 7th, 2022